When you want make calculations bracket tax or a group of annual income if the income passes a certain point will be taxed at a higher rate, You can do that by following the steps below :

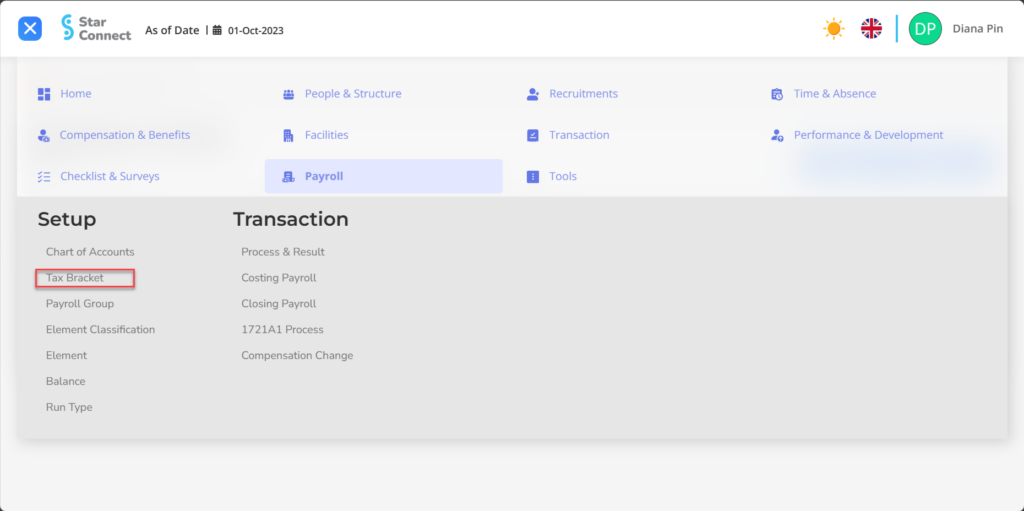

- On the Menu Payroll → Select Tax Bracket.

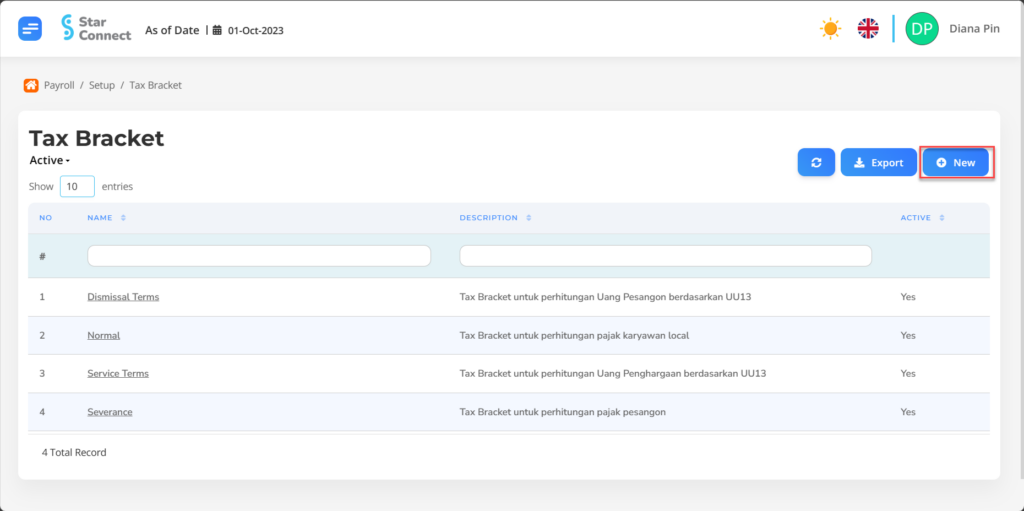

- Click the button New to create a Tax Bracket on the Payroll menu.

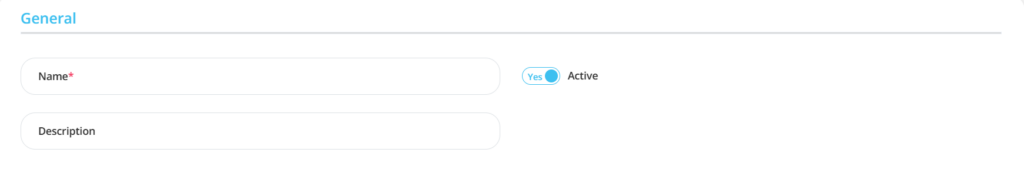

- Fill in the section General with the type of Tax Bracket you want to create.

| No | Feature | Information |

| 1 | Name | Filled with no Tax Bracket. |

| 2 | Description | Filled with description Tax Bracket. |

| 3 | Active | • Click Yes, if the Tax Bracket type is still active and processed in system. • Click No, if the Tax Bracket type is already in place not active, then the Tax Bracket type will be automatic lost in another menu. |

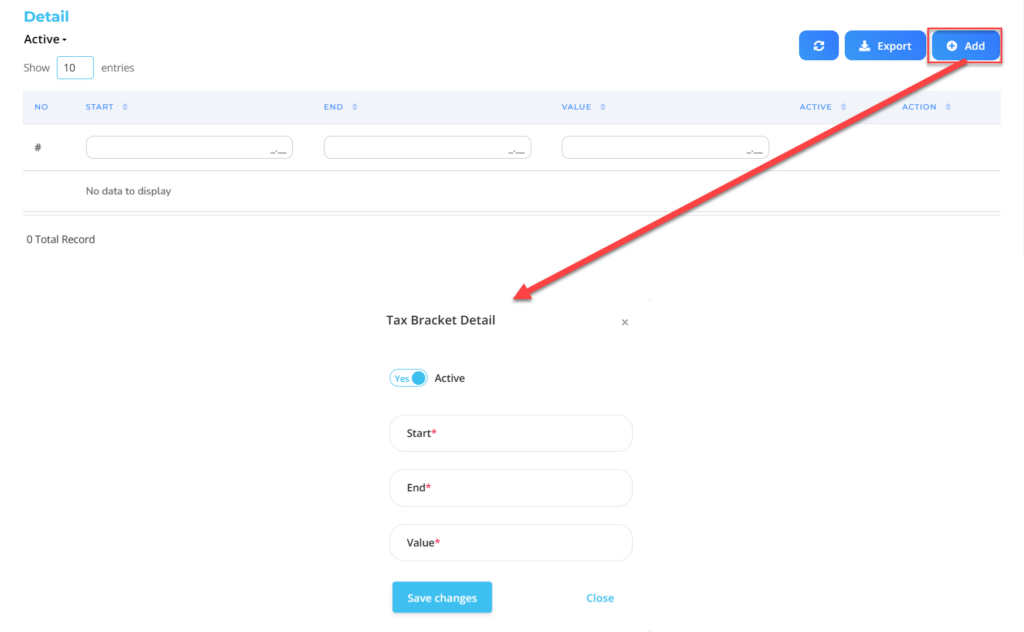

- In part Detail, click the button “Add”, then fill in the salary calculation grouping data for Tax Bracket deductions.

| No | Feature | Information |

| 1 | Active | • Click Yes, if the Tax Bracket details are still active and processed in system. • Click No, if the Tax Bracket details are complete not active, then the Tax Bracket details will be automatic lost in another menu. |

| 2 | Start | Filled with minimum nominal income employee. |

| 3 | End | Filled with maximum nominal income employee. |

| 4 | Value | Filled with tax deduction value according to nominal income. |

Do save with a click button “Save Changes” in the Tax Bracket Detail section first, then continue by filling in the other complete Tax Bracket data.

- If you have entered all the Tax Bracket information, then the final step is to do it save with a click button “Submit” at the very bottom of the Tax Bracket page.

Read Also :

– How to Make a Chart of Accounts

– How to Group Payroll

– How to Classify Elements in the Payroll Process

– How to Create Elements in the Payroll Process

– How to Create a Balance from Element Payroll